How One Idea “Rounds Up” To Three Concepts

April 2021

IDEO designers partnered with behavioral economic experts from ideas42 for a Refinement Sprint that cracked open new opportunities for partnerships.

Refinement isn’t always an exercise in honing an idea down. Our team wanted to trampoline off the behavioral research that suggests people can be generous at those checkout moments when they’re asked to donate a dollar or less. But that sort of ask is more rare in virtual shopping experiences, so maybe that presents an opportunity?

Well, as tends to be the case with online payment processing, there’s more than meets the mouse click. It can’t be as simple as a jar next to the virtual register. Here’s where our team started, what we learned, and how our “refinement sprint” became more of a “pivot sprint.”

Where We Started

How might we increase the potential adoption of “rounding up” product features by financial services channel partners capable of reaching donors at scale?

Imagine a Jenga tower, and every possible interaction within a financial transaction constituted one of the blocks in that tower. The initial “How might we…” question above clued us into which pieces we needed to test — anything related to “rounding up” or “micro donations” that exist on a per-transaction scale.

Our job as a design team was to push on as many of those pieces as possible in order to find out which ones feel loose (or ripe for design intervention). Here’s how we went about our three-week game of Refinement Sprint Jenga…

Design Research Approach

We started with some desk research (a fancy way of saying lots and lots of “Googling”), and pretty quickly we learned that many versions of this idea have been tried in the past. Affiliate credit cards and other card or bank programs have attempted to incentivize giving. Our collaborators at ideas42 helped accelerate our background research by essentially saying those efforts have largely failed to move the needle in any meaningful way.

Based upon learnings and inspiration from our desk research, the team began generating a set of initial prototypes in the form of user interface mockups to bring to our upcoming interviews. Core to IDEO’s research approach is putting tangible visual prototypes in front of people as quickly as possible so that we can begin getting feedback sooner than later.

Prototyping

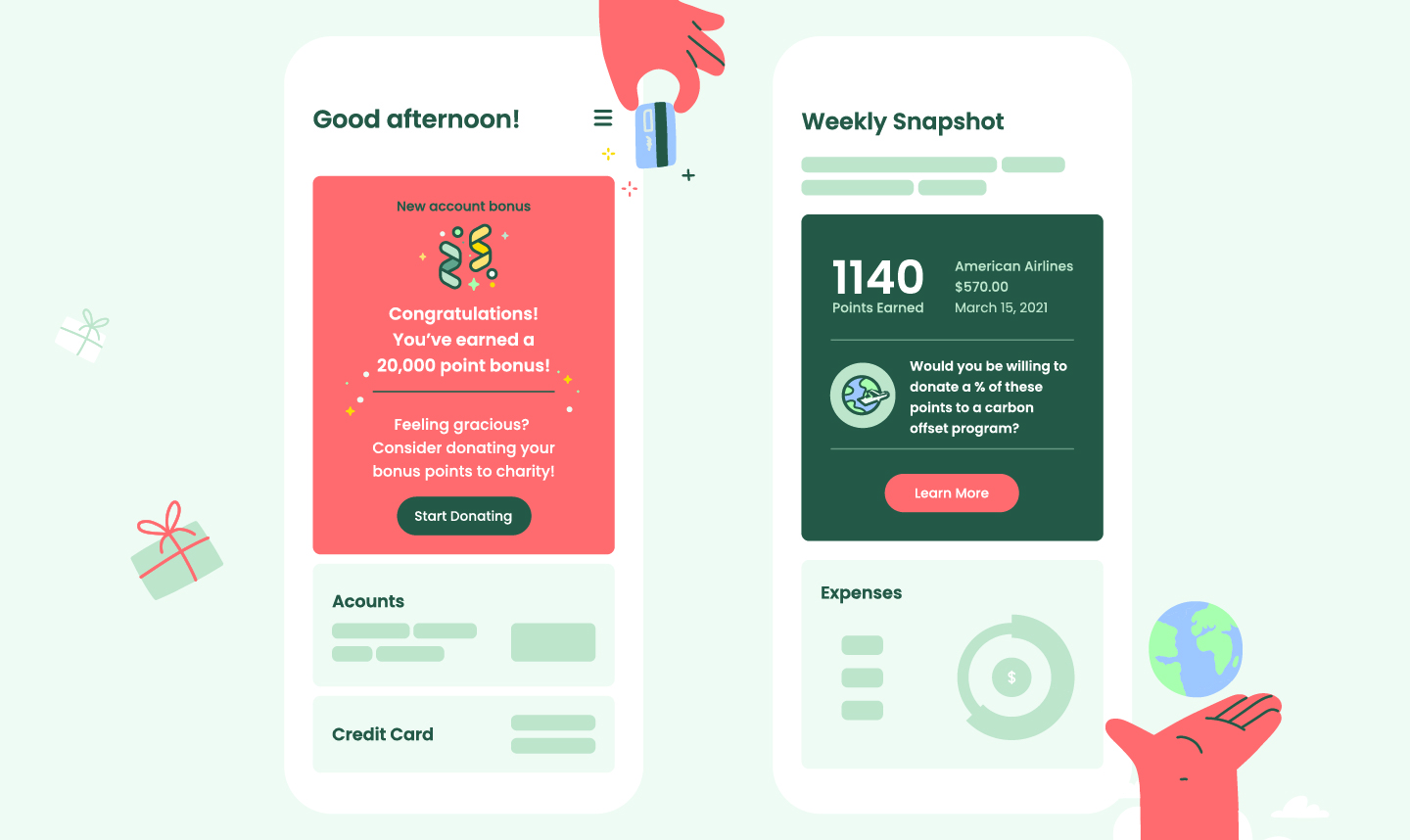

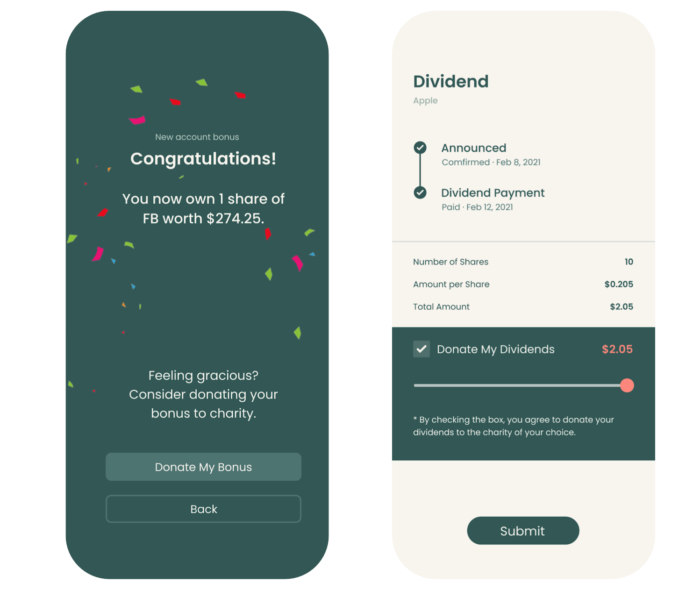

In branching out from the original idea, our team got a chance to be generative and imagine other places to push. Some of these areas included:

- Rounding down incoming money on peer-to-peer payment apps

- Donating small slices of stock dividends or returns

- Expanding the ability to donate credit card points, even as they’re earned

- Identifying payment trends like subscription models to look for margins

- Exploring other “windfall” moments when money is coming in rather than going out

The interaction designer on our team rapidly prototyped sample screens that conveyed moments when scenarios like these might manifest, and we brought them with us to interview experts.

Interview Strategy

As a team, we wanted to ensure we spoke to at least one person from the following categories within the complicated ecosystem that exists (often invisibly) behind most online transactions:

- Payment Apps & Payment Processors — Companies like PayPal, Venmo, Stripe, Square, Plaid, and others that serve as a bridge between merchants and customers’ banks or credit cards. These people could help us understand the logistics and technical realities of how money moves.

- Banks & Credit Card Networks — We wanted to build a baseline of understanding about where money starts in a transaction and what efforts have been tried in the past to build charitable giving into various consumer behaviors.

- Fintech — What could we learn from some newer, disruptive players in the financial services space (companies like Robinhood, Acorns, etc.) that are building new models or presenting new offers to customers?

- Nonprofits & Donors — All the categories above exist between the ultimate start and end points for charitable giving. We needed to ensure we tested our concepts with those two groups to ensure desirability and viability.

For each of the above categories, we tried to get a clear sense of the past, present, and future of charitable giving within the landscape. Our prototypes allowed us to discover (pretty quickly) what felt promising to industry experts, and which directions either lack excitement or present noteworthy barriers.

Three Things We Learned

Small Donations Carry Big Baggage

First of all, every online transaction carries fees. So right away, a donation of $0.79 cents is going to get eaten up by the value chain even if it’s donated directly to a nonprofit. That means somebody in the value chain (payment processor, financial institution, etc.) needs to hold onto the money until enough accrues (over the course of a week, month, year). Whoever holds that money is also carrying the liabilities that come with it.

Secondly, “round up” features have long existed within the financial ecosystem — often to encourage better savings habits. But as one industry expert said: “they’re a gateway drug.” The limited impact of this approach generated some hesitancy to consider it worth much effort to build out and integrate into their systems.

KPIs Present a Challenge

There is no “silver bullet” solution because the various stakeholders have Key Performance Indicators (KPIs) respective to their businesses. These KPIs pose significant roadblocks to feature adoption by a financial services player, but emerging research could provide waypoints for feature design.

For example, many consider the checkout flow sacred territory. Any feature playing in that real estate must be exhaustively A/B tested and shown to carry neutral or positive outcomes for partners. If that can’t be proven, the conversation is dead on arrival.

These constraints don’t mean charitable giving can’t be tethered to transactions — another Better Giving Studio concept, CoinUp, takes a third-party plugin approach to navigating this barrier. Additionally, more research is emerging that might begin to chip away at this industry perception that checkout is sacred territory. For now, though, it’s an uphill battle to inject any extra “ask” into the checkout experience.

Alternative Forms of Value Exist

One way to try and work around those KPI hurdles: target alternate sources of value, such as rewards points or donating percentages of stocks. A lot still needs to be learned and tested, but there’s ripe possibility to shake loose new value, while avoiding the technical feasibility issues of “rounding up” individual purchases.

So What’s Next?

Ultimately, this Refinement Sprint wasn’t a shining beacon of validation, but we did come away with two concepts that our IDEO team is excited about (Margins Make Money & Rerouting Rewards). Additionally, CoinUp is already pursuing another promising direction of transaction-based micro donating, and companies like PayPal are beginning to integrate interesting forms of charitable giving into their own checkout flow. Some aspects of what our team learned during this sprint have daunting roadblocks, while others feel (excitingly) like they’re already in the works.

In the world of design, uncovering these potential opportunities and barriers are exactly what a sprint like this is for! We learned which pieces are wedged into the Jenga tower tightly, and discovered which design directions are likely to make the tower wobble. But we also removed a piece or two, and — hopefully! — created an exciting opportunity that someone in our Better Giving Studio network can run with.

Other News

Dive into the Evidence